Key Features

-

![]() Tax Advantages*

Tax Advantages*

-

![]() Competitive Interest Earnings

Competitive Interest Earnings

-

![]() No Setup or Maintenance Fees

No Setup or Maintenance Fees

- Tax-advantaged retirement savings1

- Competitive interest above standard savings rates

- Traditional and Roth IRA options available

- No setup fees

- No monthly or annual maintenance fees

- Annual contribution limits apply (see current contribution limits; $6,500 as of 2023)

- Additional $1,000 "catch-up" contribution allowed for ages 50+

- $25 minimum deposit to open CD IRA

Contact one of our IRA professionals today: (806) 378-8127

We also offer Managed IRA's.

There are advantages to both traditional and Roth IRAs. One of the biggest differences is the time at which you see the most advantage. A traditional IRA provides potential tax relief today, while a Roth IRA has the potential for the most tax benefit at time of retirement.

Traditional IRA

- No income limits to open

- $25 contribution required at opening

- Contributions are tax deductible on state and federal income tax2

- Earnings are tax deferred until withdrawal

- Withdrawals can begin at age 59½

- Early withdrawals subject to penalty3

- Mandatory withdrawals at age 73

Learn more about traditional IRAs.

Roth IRA

- Income limits to be eligible to open Roth IRA1

- Contributions are NOT tax deductible

- Earnings are 100% tax free at withdrawal2

- Principal contributions can be withdrawn without penalty2

- Withdrawals on interest can begin at age 59½

- Early withdrawals on interest subject to penalty3

- No mandatory distribution age

- No age limit on making contributions as long as you have earned income

1Consult a tax advisor.

2Subject to some minimal conditions. Consult a tax advisor.

3Certain exceptions apply, such a first-time home purchase, college expenses, and birth or adoption expenses.

A SEP (Simplified Employee Pension) IRA is a Traditional IRA set up under a written arrangement that allows employers to contribute to the IRA on the employee's behalf (employer contributions may be discretionary). Generally, SEP IRAs have the same rules and requirements as Traditional IRAs.

Learn more about requirements, current maximum contribution limits and other SEP IRA information.

*Consult a tax advisor.

Important Information About Procedures for Opening a New Account:

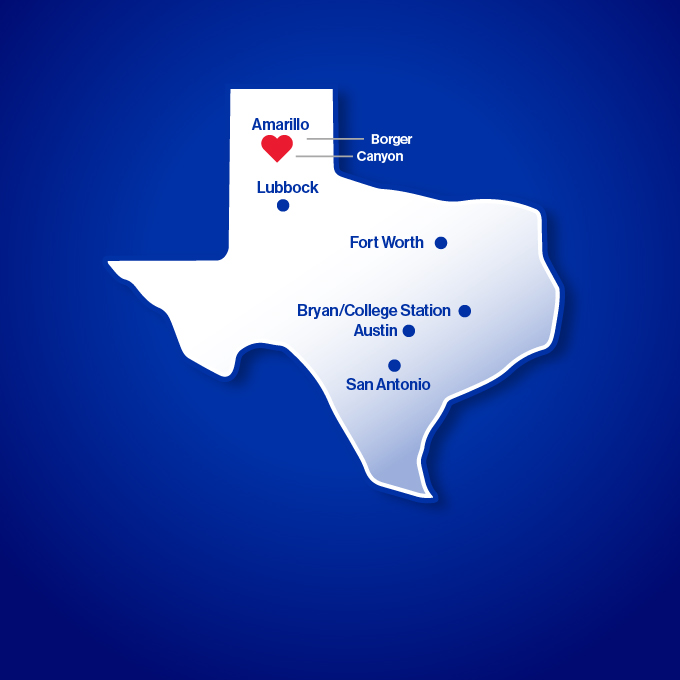

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth and taxpayer identification. We may ask to see your driver's license or other identifying documents.

FDIC Insurance

NOTICE: By federal law, as of 1/1/2013, funds in a non-interest-bearing transaction account (including an IOLTA/IOLA) will no longer receive unlimited deposit insurance coverage, but will be FDIC-insured to the legal maximum of $250,000 for each ownership category. Learn more.