Few things are more important to the future of your business than your employees — and few things are more important to your employees than their futures. Help them plan for those later years with ANB's complete range of retirement solutions.

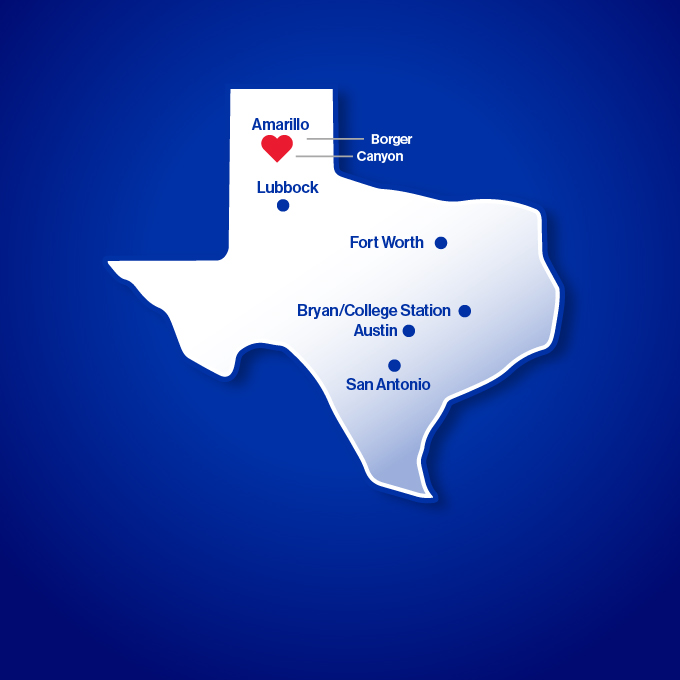

We combine the flexibility your employees want with the cost-effectiveness and administrative ease you require, backed by the support and expertise of the nation’s largest independently owned bank.

Contact one of our retirement professionals today at (806) 345-1665 or 1-800-ANB-FREE (1-800-262-3733).

Our Employer Retirement Services Include:

- Plan Design

- Plan Administration Guidance

- Compliance with regulations

- Employee Education and Enrollment

- And more!

We can help with a variety of different employer-sponsored retirement plans, click below to learn more:

Employer Sponsored Retirement Plans:

{beginAccordion h3}

401(k) Plans

With these popular plans, employee contributions actually represent deferred compensation and therefore could or may offer income-tax incentives. 401(k) plans also allow employers to make matching or profit-sharing contributions on their employees' behalf — and receive a corporate tax deduction.

- Investment may be Trustee or Participant directed

- Flexible withdrawals may be designed into the plan document

Profit-Sharing Plans

With these plans, employers may share profits with employees by funding the retirement plan in full according to a set formula or discretionary amount. However, contributions are not required every year — this is strictly at the employer's discretion. Employer contributions receive a corporate tax deduction.

- Employees are not allowed to make contributions

- Investment may be Trustee or Participant directed

- Flexible withdrawals may be designed into the plan document

Cash Balance Plans

These plans are fundamentally the same as defined-benefit plans, but with the advantages of a profit-sharing plan. The key difference is that cash-balance plans provide benefits in the form of a determinable account balance rather than an ending retirement benefit.

- Withdrawals are more flexible than with defined-benefit plans

- Advantageous to small or privately owned businesses and those who wish to receive larger retirement contributions

Money Purchase Plans

These plans are similar to profit-sharing plans, except that the annual employer contribution amount is defined by the plan document and is not discretionary. Employer contributions receive a corporate tax deduction.

- Investment may be Trustee or Participant directed

- Flexible withdrawals may be designed into the plan document

- May be combined with other retirement plans

Defined Benefit Plans

One of the key features of a defined benefit plan, is that they provide a fixed, pre-established benefit for employees at retirement. Defined benefit plans are typically more complex than other retirement plans, and that’s where our experts can help!

- Employee contributions can be required or voluntary

- Employers can contribute (and deduct on their taxes) more than other retirement plans allow

{endAccordion}