Key Features

-

![]() Quick Local Decisions

Quick Local Decisions

-

![]() Awesome Customer Service

Awesome Customer Service

-

![]() Variety of Programs

Variety of Programs

We offer easy, fast home loans — combining the convenience of online application with the speed and service of Amarillo National Bank. ANB Mortgage is proud to be the largest mortgage lender in the Texas Panhandle.

What can you expect from us?

- Easy application: Applying for a loan from ANB is simple — tap a screen and go.

- Fast closings: The national average for closing a mortgage loan is 42 days. In most cases, ANB closes eligible loans in two weeks or less.

- Local people: We live here. You can ask for them by name. They’ll know you and your neighborhood.

- First-time buyers: Home ownership is part of financial independence and a big part of our community health. Our first-time buyer programs help you reach this milestone.

- We get awards: Guess who has been voted Amarillo’s Best Mortgage Company every year since 2005? (Hint: It’s us!)

- Family ownership: Our decision-making isn’t driven by Wall Street or investors. Instead, it’s driven by honesty, customer service, and keeping our community strong.

To learn more, schedule a personal consultation with one of our expert Loan Officers today.

It is the objective of Amarillo National Bank to make loans for productive purposes which are consistent with sound credit principles and which are in the best interests of the bank, its stockholders, its customers, and the community.

It is the intention of the bank that its lending power will be used to promote growth in its demand deposit base, thereby increasing the bank's ability to produce future earnings growth, as well as promote the economic growth of its community and trade area. The bank's lending resources will be allocated in a manner consistent with prevailing or anticipated economic and money market conditions in accordance with sound bank asset management practices.

In addition, the bank recognizes that they have a continuing and affirmative obligation to help meet the credit needs of its trade area, and will not discriminate against any applicant on a prohibited basis with respect to any aspect of the credit transaction.

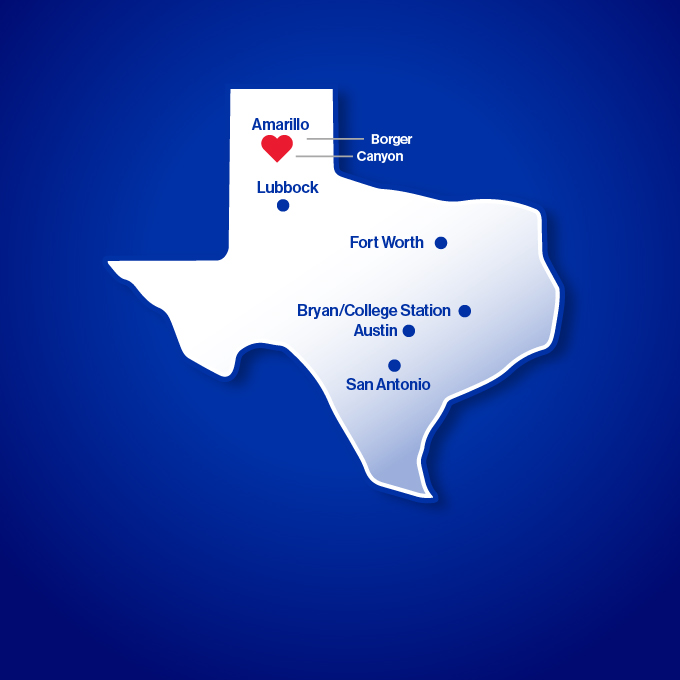

The bank's trade area will be considered to be:

- Primary Trade Area — Potter, Randall, Hutchinson, Carson, Brazos, Tarrant, Travis Counties, SMSA.

- Secondary Trade Area — General trade territory, roughly defined as the State of Texas.

- Tertiary Trade Area — Those areas of our "downstream" correspondent banks where over line requests are generated.

Important Information About Procedures for Opening a New Account:

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth and taxpayer identification. We may ask to see your driver’s license or other identifying documents.

A great choice for most borrowers looking for lower rates and larger down payments.

- 3% down payment

- Gifts allowed

- Mortgage Insurance not required with 20% or more down payment

- $832,750 loan limit

Government-backed mortgage option with looser financial qualifications and lower credit score requirements.

- 3.5% minimum down payment

- 580 minimum credit score

- Gifts allowed

- Monthly Mortgage Insurance for life of loan

- $541,287 loan limit

- Down Payment Assistant Programs Available

Favorable home financing that's available exclusively to current or former military service members and their spouses.

- No minimum down payment

- 580 minimum credit score

- Mortgage Insurance not required

- Gifts allowed

- $832,750 Loan Limit

Government-backed mortgage option that's made for property in rural areas across the country.

- No minimum down payment

- 640 minimum credit score

- No max purchase price

- 6% max seller contribution

- Gifts allowed

- No first-time home buyer requirement

- Income limits apply

ANB-backed financing that's available for homeowners who do not meet standard requirements for conventional, FHA, and VA loans.

- 5% to 20% down payment required, depending on credit

- No minimum credit score

- Mortgage Insurance not required

- Primary residence

- Purchase and refinance transactions allowed

- Credit & underwriting flexibilities for borrowers that do not meet standard requirements

Perfect for qualified professionals looking for financial flexibility on down payments.

- No minimum down payment

- 620 minimum credit score

- Mortgage Insurance not required

- Primary residence

- Purchase transactions

- $1,250,000 loan limit

- Designed for Architects, Attorneys, CPAs, Engineers, Nurses, Pharmacists, Physicians, Physician Assistants and Physical Therapists.

Financing that's designed for purchasing a lot property to hold onto or build upon.

- 10% minimum down payment

- Up to 20 acres

- Must be residential

Short-term mortgage financing that helps bridge the gap between buying a new home and selling your previous one.

- No minimum down payment

- 620 minimum credit score

- $1,000,000 loan limit

Exactly as it sounds — straightforward mortgage financing with no down payment required for qualified homebuyers.

- No minimum down payment

- 620 minimum credit score

- Primary residence

- Purchase transactions

- $375,000 loan limit

- Mortgage Insurance not required

Build your dream home with an ANB Construction Loan.

- 10% minimum down payment

- 640 minimum credit score

- Available for primary residence or second home

- Interest only payments during construction phase

Specialized financing options are available for loans over the standard limit of $832,750.

- Down payment requirements start at 10% and are dependent upon the home purchase price and credit qualifying factors

- 700 minimum credit score

- Primary residences

- Second homes

- Customized options are available