Key Features

-

![]() Competitive, Tiered Interest Earnings

Competitive, Tiered Interest Earnings

-

![]() Enhanced Access to Funds

Enhanced Access to Funds

-

![]() Free Digital Banking

Free Digital Banking

- Competitive, tiered rates on balances of $1,000 or more

- Higher balances earn higher rates

- Enjoy flexibility with enhanced access to funds, including direct check writing:

- Unlimited in-person withdrawals or by mail

- Free transactions by pre-authorized automatic, telephone, checks, drafts, debit cards, or other similar order

- Avoid a $4 monthly service fee by maintaining a $1,000 minimum daily average balance

- $50 minimum deposit to open

- Free digital banking, including:

- Online banking

- Mobile banking

- eStatements

- Free mobile pay services

- Transfer funds with Zelle®

- Overdraft protection

- NSF charges: $19 per item

Important Information About Procedures for Opening a New Account:

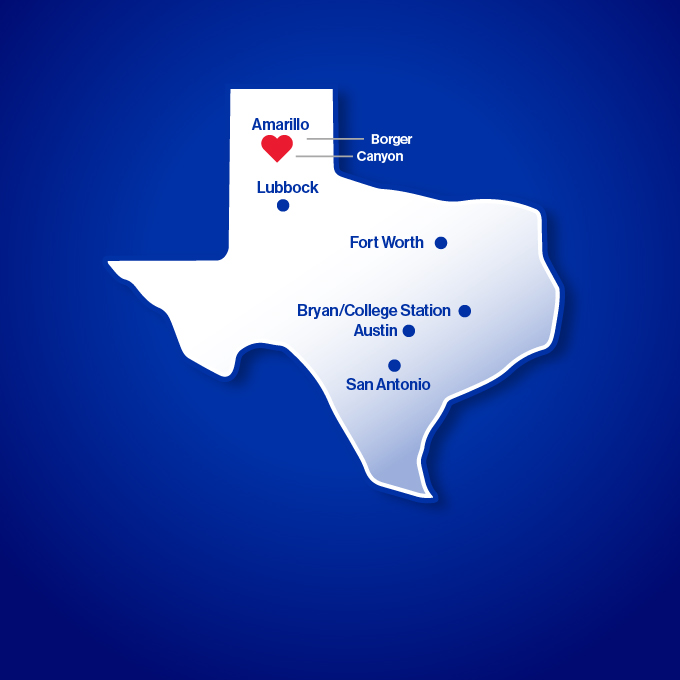

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth and taxpayer identification. We may ask to see your driver's license or other identifying documents.

FDIC Insurance

NOTICE: By federal law, as of 1/1/2013, funds in a non-interest-bearing transaction account (including an IOLTA/IOLA) will no longer receive unlimited deposit insurance coverage, but will be FDIC-insured to the legal maximum of $250,000 for each ownership category. Learn more.