Thinking of buying a new home?

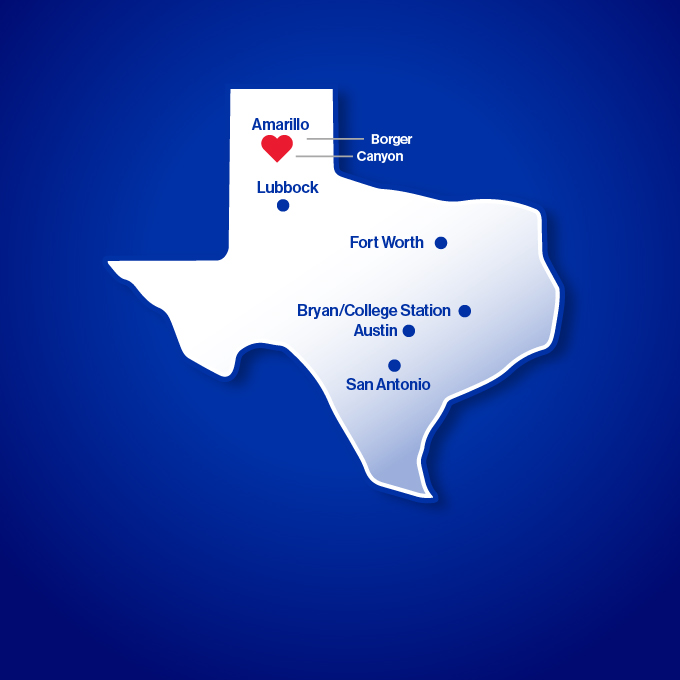

Congratulations! Home ownership is an important step toward financial independence — and a significant marker of a community's overall health. That's why, at ANB, we work hard to help our along the road to finding a dream home that fits both their lifestyle and their budget. With home loan officers based right in your city, we know your Realtor®, your neighborhood, and the local economy. That means quick decision-making, less hassle, and fewer headaches.

To get started, check out the helpful information below:

{beginAccordion h3}

The Financial Side of Choosing the Right Home

A new home is one of the largest investments most of us will ever make. That's why it's smart to balance the emotional side of the purchase with some savvy financial decisions.

Type of Home

Your choice of single-family, condominium, townhome or duplex can affect your buying power in a number of different ways. For example, to secure a mortgage for purchasing a duplex, you may need a larger down payment and a higher credit score than you might for a single-family home. The overall loan approval process may be more lenient or stringent, based on the property type you choose. Talk your options over with your ANB Mortgage Specialist if you have any questions.

New vs. Existing Home

When considering whether to purchase a new or existing home, financial considerations should come into play. For example, you may be able to afford a larger home if you purchase an existing home. Newer homes are more likely to be farther from the city center and most employers, which could drive up your commute costs. Maintenance costs are another consideration. Older homes may have structural defects that might require repairs before you can even move in, and older appliances will need replacing sooner. If you do opt for an older home, it's smart to carefully inspect the interior and exterior for defects. The additional renovation costs may add up over time and exceed your maintenance estimates.

Features

Gas vs. electric heating, number of bedrooms and baths — these are more than just a lifestyle decision, as all of these characteristics will influence the price of the home and your monthly housing expenses.

Neighborhood Considerations

Location: Would you rather live in the city, the country or the suburbs? Do you want to be near parks or the library? What about shopping centers? Is it important for you to be near major highways or public transportation? Get a feel for the surrounding area by exploring the neighborhood and talking to residents.

Other neighborhood or location factors that can affect your property value include:

- Crime rates

- School system quality

- Economic growth and stability of the area

Property Tax

Real estate taxes and other assessments can be a huge factor in your decision about whether you can or cannot afford a particular home or area. You can search for the most recent tax information and appraisal values on your area's appraisal district website.

Choosing a Real Estate Agent

For most home buyers, having a real estate agent makes sense. The agent's role is to help you find the home that best suits your needs and price range, guiding you through the entire search and purchase process.

Because agents have tools and experience the average home buyer doesn't, they can really help you:

- Save time and effort

- Understand the paperwork and legal requirements

- Find the neighborhood for your lifestyle

- Find the home that meets your needs

- Understand property values in your area

- Negotiate the final offer process

What's the difference between a real estate agent and a REALTOR®?

REALTORS are members of the National Association of REALTORS. This professional organization requires its members to commit to treating all parties to a transaction honestly, subscribe to a strict code of ethics, and maintain a higher level of knowledge about buying and selling real estate. REALTORS may also have access to marketing tools and extra training to add to their expertise.

Making the Mortgage Process Simple

The mortgage process may seem daunting, but it's really rather simple — and ANB will be there for you every step of the way.

Get pre-approved

You can apply for a loan before or after finding the home you want to purchase; however pre-approval gives you a real edge in house hunting. If you already know how much you can borrow, you can shop much more wisely. Plus, having your financing already arranged can give you some leverage in negotiating with the seller.

ANB offers two simple options:

- Apply online via our Mortgage Center.

You'll receive a loan decision instantly (subject to verification of the information you submit). - Make an appointment with a Mortgage Lending Officer by calling (806) 358-3008 or 1-800-ANB-FREE (1-800-262-3733).

This appointment should take approximately one hour. Because all of our lending decisions are made right here in Amarillo, we can typically give you an answer by the time you leave the office. To save a little time, download and fill out a Mortgage Lending Application (requires Adobe Acrobat Reader) and bring the completed form with you to your appointment.

Work with your real estate agent to negotiate the best deal for your dream home

When you have found the home that best meets your needs, you are ready to make an offer. In most cases, your real estate agent will present your offer to the seller. Don't be discouraged if the seller rejects your first offer. It's relatively common for the seller to make a counter-offer — which you can also counter, going back and forth until (hopefully) a selling price and contract terms are agreed upon.

You may be asked to provide earnest money as a "good faith" deposit, showing that you're serious about purchasing the home. There is no required dollar amount — the amount is usually a portion of the purchase price.

Once a contract is agreed upon, earnest money is held in an escrow account at the title company and can be applied toward the down payment or closing costs. In some cases, the buyer must pay the deposit in cash.

Sign the purchase contract

This is the legally binding agreement that details the final terms for the purchase of the home — including price, closing date and estimates on the closing costs. When you sign the purchase contract, you agree to purchase the property under the negotiated terms and price. All parties involved (including real estate agents) will sign the contract, and a copy must be provided to the lender and title company.

Understanding closing costs

Some closing cost fees are required by law, while others are negotiated as part of the purchase offer. There are no definitive rules on who pays which closing costs — this is part of the negotiation process between buyer and seller.

For instance, the seller may be willing to negotiate full or partial payment of appraisal fees, loan points, the credit report request and inspection fees. Usually the seller is responsible for the brokerage fees, as this is compensation to the real estate agents for their roles in the sale of the home.

Some closing cost fees are required by law, while others are negotiated as part of the purchase offer. There are no definitive rules on who pays which closing costs — this is part of the negotiation process between buyer and seller.

For instance, the seller may be willing to negotiate full or partial payment of appraisal fees, loan points, the credit report request and inspection fees. Usually the seller is responsible for the brokerage fees, as this is compensation to the real estate agents for their roles in the sale of the home.

Understanding option money

Option money is sometimes given in consideration for the option to purchase the property subject to the "okay" of all required inspections within a specified time period. If any inspections come back negative — or the buyer simply changes his or her mind — the earnest money and option money are refunded, so long as it is done within the stated option period.

Option money is sometimes given in consideration for the option to purchase the property subject to the "okay" of all required inspections within a specified time period. If any inspections come back negative — or the buyer simply changes his or her mind — the earnest money and option money are refunded, so long as it is done within the stated option period.

Complete the mortgage loan application and documentation process

Even if you're pre-approved for a mortgage, there are more steps to take once the contract is executed.

Once ANB receives your executed contract, we will order the following documents:

- Title commitment — This documents that the new property owner will have the right to ownership. After loan closing, a

- Title Insurance Policy will be provided by a title company that ensures against any defect in the title of real estate.

- Property appraisal — This determines the acceptable market value of the real estate property.

- Flood certificate — This determines whether the property is in a flood zone and if flood insurance is necessary.

You will be responsible for providing the following:

- Mortgage loan processing documents — All documents pertaining to processing the mortgage loan application, along with proof of income and assets and any additional documents requested by the loan officer.

- Proof of homeowner's insurance — You may choose any homeowner's insurance company, as long as it provides personal liability and coverage against multiple perils that could affect the dwelling and its contents. ("Perils" refers to events such as fire, lightning, tornado, vandalism, theft, etc.)

- Termite inspection — You are responsible for arranging a termite inspection with the company of your choice. If the result is positive, appropriate treatment is required prior to closing on the mortgage loan transaction.

- Well/septic inspection — This is required for all properties that have a private well and/or septic system. The well inspection's purpose is to check for bacteria in the water, while the septic inspection is designed to ensure that the septic system is large enough to accommodate the size of the home. If the result of either inspection is negative, appropriate treatment is required prior to closing.

- We also recommend you secure a General Home Inspection. It's not required, however it can provide you with a wealth of information about the overall mechanics of the home.

Close on your new home

Upon final approval of all processing documentation and inspections, Amarillo National Bank will send the closing package to the title company. Our closing documents are combined with those of the title company, which then generates a HUD-1 Settlement Statement.

This statement includes:

- The closing costs required of both buyer and seller

- Total funds required to close, minus any down payment (if applicable)

- Earnest money, closing costs and costs paid by the seller

Typically, 24 hours prior to the closing day, your real estate agent will contact you with the amount needed to bring to closing. This figure must be given in the form of a cashier's check or money order payable to the title company.

On closing day, all required parties will meet at the title company to sign the closing documents. Once everything's signed, that's it! Your dream home is yours.

{endAccordion}