Personal Loans

Auto Loans

- Competitive rates on new or used vehicles

- Affordably refinance your current vehicle

- Recreational vehicle loans also available

Personal Term Loans

- Competitive rates for projects, repairs, vacations, and more

- Repayment terms customized to fit your unique needs

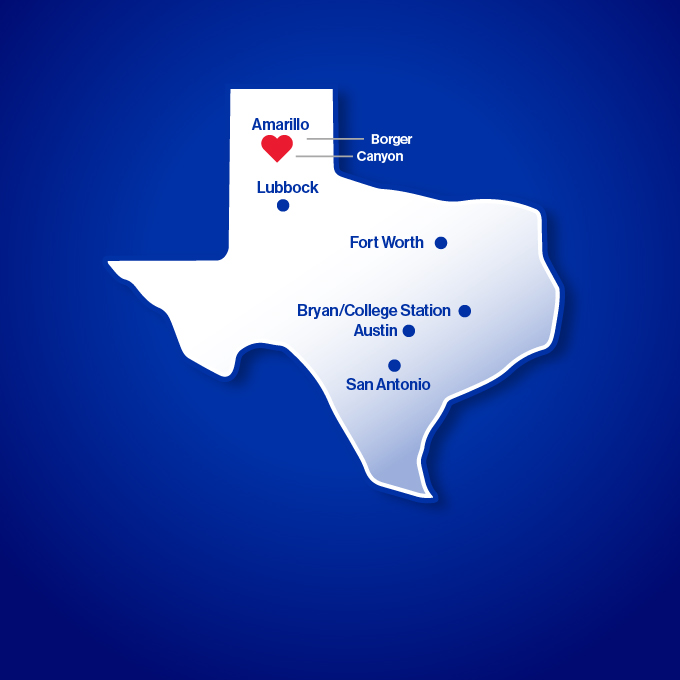

- Friendly Texas service from start to finish