Key Features

-

![]() Competitive Rates

Competitive Rates

-

![]() Local Processing

Local Processing

-

![]() Quick Decisions

Quick Decisions

- Affordable financing for your farming or ag operation

- Competitive rates for a wide range of agribusiness-related needs:

- Cattle

- Feed

- Equipment

- Rolling stock

- Feed stock

- Real estate

- Dairies

- And more

- Repayment terms customized to fit your operation's unique needs

- Lenders experienced in local agricultural standards

- Quick, local decision-making and processing

- Friendly Texas service from start to finish

It is the objective of Amarillo National Bank to make loans for productive purposes which are consistent with sound credit principles and which are in the best interests of the bank, its stockholders, its customers, and the community.

It is the intention of the bank that its lending power will be used to promote growth in its demand deposit base, thereby increasing the bank's ability to produce future earnings growth, as well as promote the economic growth of its community and trade area. The bank's lending resources will be allocated in a manner consistent with prevailing or anticipated economic and money market conditions in accordance with sound bank asset management practices.

In addition, the bank recognizes that they have a continuing and affirmative obligation to help meet the credit needs of its trade area, and will not discriminate against any applicant on a prohibited basis with respect to any aspect of the credit transaction.

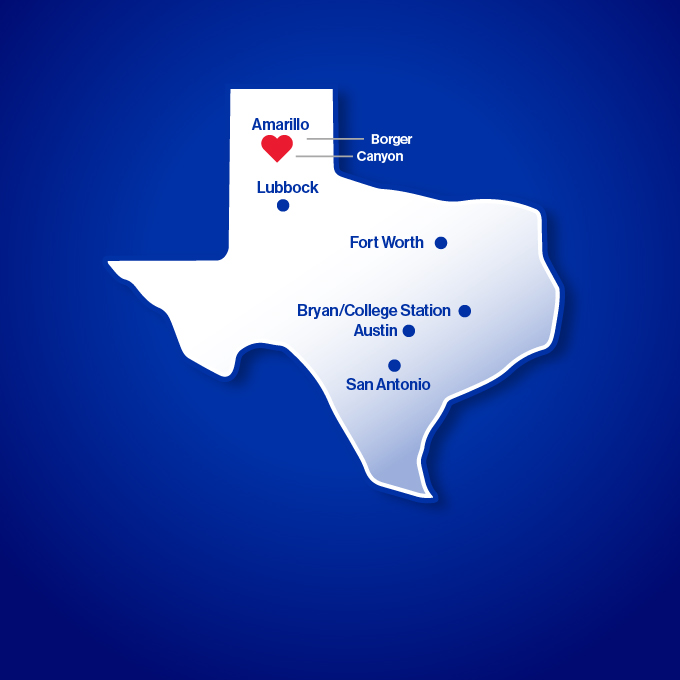

The bank's trade area will be considered to be:

- Primary Trade Area — Potter, Randall, Hutchinson, Carson, Brazos, Tarrant, Travis Counties, SMSA.

- Secondary Trade Area — General trade territory, roughly defined as the State of Texas.

- Tertiary Trade Area — Those areas of our "downstream" correspondent banks where over line requests are generated.

Important Information About Procedures for Opening a New Account:

Amarillo National Bank complies with section 326 of the USA PATRIOT Act. Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account such as name, address, date of birth, and taxpayer identification. We may ask to see your driver’s license or other identifying documents.