ANB will never solicit for personal identification information via the Internet or telephone.

These days, there are multiple ways identity thieves can gain access to your personal identification information and use it against you. ANB wants to help you stay smart about fraud and identity theft, so we've put together a thorough overview.

Official Fraud Protection Guide

{beginAccordion}

Top 12 Cyber Security Tips

Build upon your security by following these top 12 self-protection strategies:

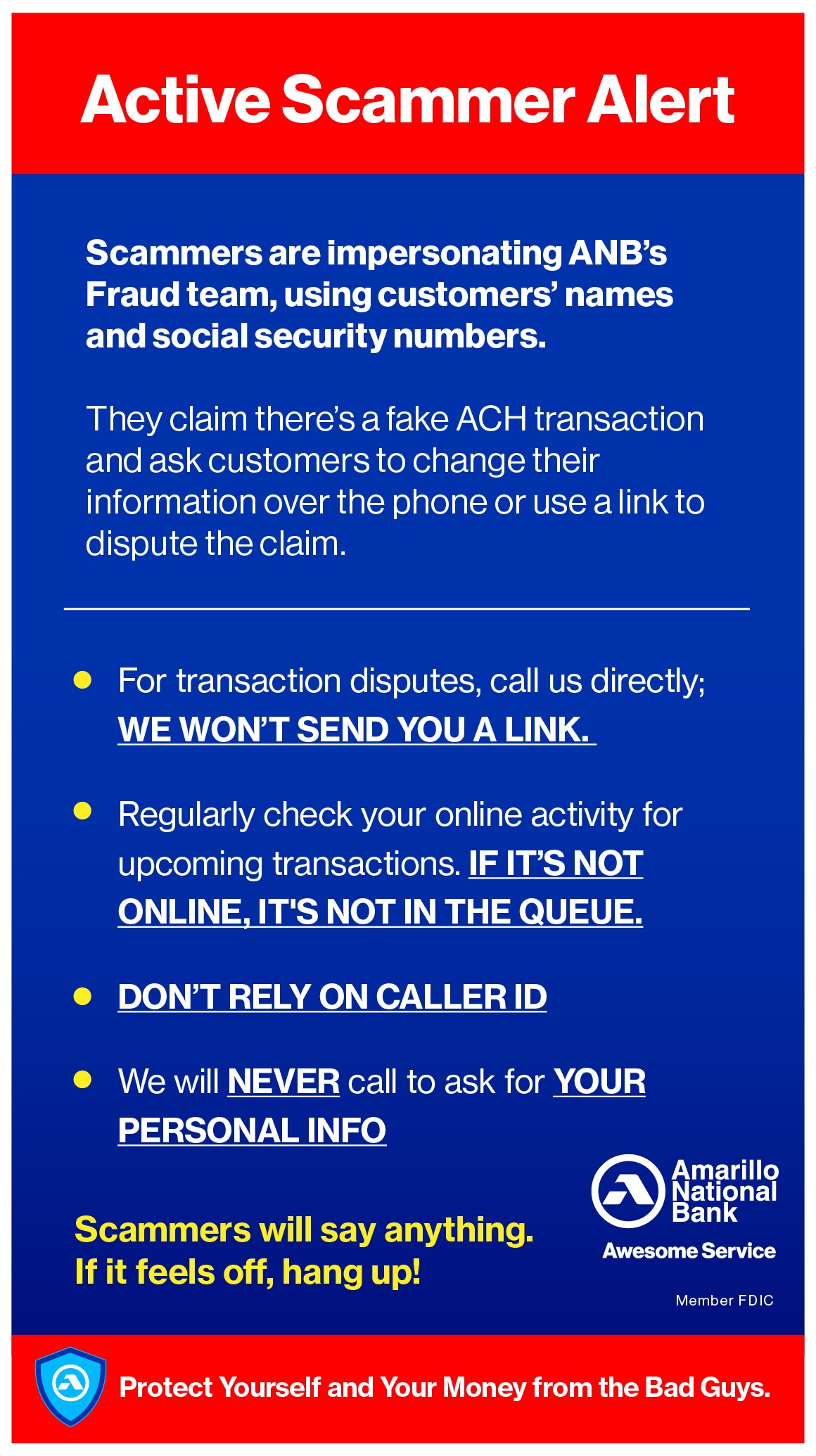

- We will NEVER call you to ask for personal information or account details. If someone does, it is a scam.

- Avoid free, web-based email accounts, which are more susceptible to cyber attacks.

- Always opt-in to two-step account verification when possible.

- Strengthen all of your passwords, including your ANB password. If your password is “password” or “123456,” then cyber-thieves will crack it.

- Be careful what you post publicly on social media, especially if it involves personal or work details.

- Be suspicious of any requests to act immediately or to keep something secret.

- Pay attention to digital signatures to verify authenticity of emails or documents.

- Do not open unsolicited or spam email from unknown parties. Never click links in these emails.

- Watch out for sudden changes in normal behavior, like a business contact using a personal email address rather than a work address.

- Pay attention to domains and email addresses. A slight difference (.co instead of .com) can take you to a fraudulent site.

- Update operating system software and apps when new versions are released.

- Check your bank account frequently. If your account balance or transactions seem suspicious, contact us immediately.

Basic Identity Protection

- Carry only necessities on a daily basis. Items like a Social Security card should be stored safely at home.

- Make photocopies of the vital contents of your wallet. Copy both sides of your driver's license, credit cards, etc. If your wallet is stolen, these copies will let you know what's missing — plus you'll have all of the account numbers and key phone numbers necessary to report the theft.

- Carefully protect your credit card.

- Shred documents containing personal or financial information before discarding. Most fraud and identity-theft incidents happen as a result of mail and garbage theft.

- Go paperless! By signing up for ANB Online Banking, you can receive Online Statements or downloadable E-statements free of charge. How does this help? The fewer personal documents you have sent through the mail, the less chance there is for possible fraud.

- Do not provide your Social Security number online or by phone unless absolutely necessary. If your Social Security number is requested (to sign up for a service, for example), ask if you can provide some other identifier instead.

Business Email Compromise (BEC)

What is BEC?

It is a phishing scheme in which an attacker impersonates a high-level executive (or employee) and attempts to trick an employee or customer into transferring money or sensitive data. Since 2013, there has been over $12 Billion in lost dollars due to BEC.

How is BEC initiated?

Typically an email arrives that appears to be from a high-level executive within the company — or even a business partner or company attorney. Since the email address has been spoofed, it appears to be legitimate. A request for a wire or ACH transfer is included in the email, which urges the recipient to take immediate action. The fraudulent email might claim that a supplier requires prompt payment for a service rendered OR the fraudsters are impersonating lawyers and reaching out to potential victims to handle supposedly confidential or time-sensitive matters…Please note this same thing can happen over the phone instead of just email.

How to prevent BEC?

- Carefully scrutinize all email requests for transfer of funds and develop a policy that money cannot leave your organization based off of emails alone.

- Use two factor authentication with your vendors or banks before large transfers take place.

- Do not use free email services for business purposes (examples: Yahoo, Gmail, etc…) instead establish a company domain name and use it to create an official company email account.

- Update your email gateway to flag keywords that contain: Payment, Urgent, Sensitive, Secret. All of these words are common in BEC emails.

- Flag other emails where the “reply” email address doesn’t match the “from” address.

- Be mindful of what is posted to social media such as places of residence, birthdates, favorite foods, travel plans. Cybercriminals can use this information to personalize their fraudulent emails and to social engineer something from you.

- Run updated antivirus and malware software.

- Typically BEC attacks are very targeted and the fraudsters know a lot about you. If the fraudsters gained access to your PCs via a phishing attack or malware, they can spend weeks or months studying your organizations vendors, billing systems and the CEO style of communication.

What if you’re a victim of BEC?

Time is off the essence. Contact your financial institution immediately and request a recall of the funds. Also contact your local FBI or law enforcement. Finally, regardless of dollar loss, if you are an BEC victim file a complaint referral form with the Internet Crime Complaint Center.

Credit Card Protection

Basic credit card protection

- Sign the back of a new card as soon as you get it. If you don't, a thief could sign it for you — and use it. For even greater security, don't put your signature on your cards at all. Instead, write "PHOTO ID REQUIRED."

- Memorize your personal identification number (PIN). Don't write it down in your wallet or on the back of the card.

- Never leave your cards unattended — even at work, at your sports club, in a shop or in a doctor's office.

Using credit cards on the phone

- NEVER give your account number over the phone unless you initiated the call.

- If someone calls you claiming to be a bank representative and asks for your PIN, don't give it to them. Report it to us immediately.

- Be careful! Mail and telephone solicitations may not all be legitimate. Be careful concerning offers that sound too good to be true, and NEVER give callers your card number over the phone or by mail unless you want them to charge your account.

Making a purchase

- Do not respond to high-pressure sales tactics until you have had enough time to make a careful and informed decision.

- Always check your card when you get it back in a store or restaurant. It's easy to forget your card when you're in a hurry. And it's easy for waiters or salespeople to give you the wrong card when they are in a hurry.

- Always take your charge slips and destroy the carbons (if there are any).

Ensuring the safety of your ANB credit card statement

- Know when your statement is due. If you don't receive it on time, contact us immediately. Keep your receipts and check them off against your monthly statement. This is a simple way to discover whether someone else has used your card, or if your sales draft has been altered by a dishonest merchant. Report any and all errors.

- Go paperless! By signing up for Credit Card Account Access, you can receive Online Statements or downloadable E-statements free of charge. How does this help? The fewer personal documents you have sent through the mail, the less chance there is for possible fraud.

- Shred or otherwise destroy any paper billing statements before discarding. This can help prevent your account information from falling into the wrong hands.

E-Mail and Online Security

Thanks to the Internet, access to information, entertainment, products and services is greater than earlier generations could have imagined. The flip side, however, is that the Internet — and the anonymity it affords — also can give online scammers, hackers and identity thieves access to your computer, personal information, finances and more.

With awareness as your safety net, you can minimize the chance of an Internet mishap. Being on guard online helps you protect your information, your computer, even yourself.

- Protect before you connect

- Protect after you connect

- Protect yourself if something goes wrong online

Learn more about Online Security and Identity Theft

- The U.S. government and the technology industry provide some practical tips and information at OnGuardOnline.gov.

- The nonprofit National Cyber Security Alliance has some great resources at Stay Safe Online

- The CERT® Program — part of the federally funded Software Engineering Institute (SEI) at Carnegie Mellon University — has a detailed step-by-step approach to home computer security.

- Microsoft® has some great information on protecting yourself, your computer and your family.

- The Federal Trade Commission's "Fighting Back Against Identity Theft" is a one-stop national resource on identity theft.

Fraudulent E-Mails and Phone Scams

Customers and non-customers have received, in the past, an email stating there is a security issue with their account.

Example

Dear Customer,

Because your password was entered incorrectly five time, online access to your account at 'www.anb.com' has been locked for security purposes.

To remove the limitation, please click on the following link:

http://www.anb-pymt.com/

Thank you,

anb.com

This is NOT Amarillo National Bank, we will not call, text or email to solicit personal information. If you have given your information, please contact Amarillo National Bank at (806) 378-8000 or 1-800-ANB-FREE (1-800-262-3733) IMMEDIATELY.

ANB will never solicit your personal or account information over the telephone, e-mail or cell phone.

- Your account information is stored when you open the account and backed up daily. We will not need this information again.

- We will only ask you to verify personal information if you call us, but not enough to create a transaction. – last 4 of social and account number.

We will never use automated dialers, text messaging or e-mails to verify info.

- Automated VOIP (Voice Over IP) Phones (basically a computer) is used to call numbers in a specific range using the area code. They can even show the bank's phone number on the caller ID.

- Once they have the account info, it takes an average of 47 minutes to make a "white card" and use it in an ATM machine

- Most of these scams occur over the weekend in hopes that the bank won't respond until the following week.

Be aware of who you are talking to.

- Don't give out account information to anyone who calls or e-mails you.

- Make sure the phone number you call is genuine.

- Be certain the website or email address you are using is correct.

- If you have questions or concerns call your personal banker.

If you feel that your account or personal information have been compromised, please contact customer service at (806) 378-8000 or 1-800-ANB-FREE (1-800-262-3733) immediately for assistance.

Password Tips & Tricks

For years, ANB has worked with several cyber threat intelligence organizations and we are always actively monitoring cyber security and fraudulent activity. We want you know your money is safe and we will continue to make sure of that!

The best fraud prevention starts with you!

Be smart about security:

- Pay close attention to your accounts. If you haven’t signed up for security and transaction alerts, this is a good reminder to do so.

- Make sure your username is unique. Don’t reuse a name you use on another site.

- Strengthen your password. Passwords like “password” or “123456” are easily guessed by cyber-thieves.

- Keep PINs and security codes to yourself. If any call or message “from the bank” seems suspicious, hang up and call us back at 806-378-8000. We don’t mind.

- Don't open unknown links or attachments. Be on the alert when it comes to emails and direct messages.

{endAccordion}